Integrated Environmental Tech, IEVM, Profile, Summary

Integrated Environmental Tech, IEVM, Profile, Summary

Integrated Environmental Technologies (IEVM), markets and sells anolyte disinfecting solution under the Excelyte™ brand name and sells a cleaning solution under the Catholyte Zero™ brand name. Both solutions are produced by the Company’s proprietary EcaFlo™ equipment which utilizes an electrolytic process known as electrochemical activation to reliably produce environmentally responsible solutions for cleaning, sanitizing and disinfecting. Excelyte™ solutions are EPA-registered hard surface disinfectants and sanitizers approved for hospital-level use and are also approved for use as a biocide in oil and gas drilling. The products can be used safely anywhere there is a need to control pathogens, bacteria, viruses, and germs. Catholyte Zero™ solutions are an environmentally friendly cleanser and degreaser for janitorial, sanitation and food processing uses. The Company is currently focused on selling its Excelyte™ solutions to oil and gas production companies, healthcare facilities and agriculture and dairy farmers.

Oil & Gas Industry

Excelyte™ is being adopted by natural gas producers in the western U.S., especially in Utah and New Mexico.

Excelyte™ is considered an industry leader in being able to provide an environmentally conscious solution for disinfecting and sanitizing. It is EPA registered as an antimicrobial. For more than 20 years, Excelyte™ has been used for the enhancement of oil and gas production. It is frac fluid compatible and pH neutral. It is certified by the NSF, USDA, and EPA. It is the only EPA-registered disinfectant that has been proven completely effective against all bacteria and virus tested. We provide customers with chemical-free science-based disinfecting, sanitizing and cleaning solutions produced by ECA technology to promote environmental, worker and consumer health safety wherever pathogens must be controlled

Excelyte’s™ unique ability to disrupt viruses and bacteria cell structure while being able to fully degrade leaving no ecological footprint behind, makes it both strong but safe in many applications. The ability to disrupt the cell structure prevents organisms from mutating and becoming resistant, reduces the possibility of superbugs. It does not become resistant to microbes, as do most chemicals. It kills oil field bacteria with no harmful by-products. Excelyte™ carries a NSF-61 Water Treatment equipment certification and is considered non-hazardous by the US Department of Transportation. Protective equipment and site safety measures are not required for Excelyte™ applications. Once Excelyte™ has fully degraded, it leaves no ecological damage to well sites.

For every one million gallons of water used, we only need to add about 5,000 gallons of Excelyte™ to treat at 2.5ppm. It costs millions of dollars per frack per well but the cost of adding Excelyte™ is a fraction of a percentage of that overall cost.

Excelyte™ has been registered by the EPA for use in the following applications:

-

Fractured & Produced Water

-

Sour Wells

-

Water Flood Injection Waters

-

Oil and Gas Transmission Lines

-

Heater Treaters

-

Hydrocarbon Storage Facilities

-

Gas Storage Wells

Zero Environmental Impact

Kills 99.9999% of microbes, 100% eco-friendly.

EcoTreatments™ produces powerful, eco-friendly disinfecting and sanitizing solutions named Excelyte™ and Catholyte Zero™ using our proprietary EcaFlo™ technologies. Excelyte™ is a powerful antimicrobial solution that is both biodegradable and non-accumulative. The key active ingredient, hypochlorous acid, is derived from naturally occurring salt minerals and water. When exposed to environmental conditions, Excelyte™ quickly degrades into salt and water leaving no ecological footprint.

A BETTER SOLUTION

Ecotreatments™ solutions are an environmentally conscious approach to meet today’s growing demands for disinfecting, sanitizing, and cleaning products that are non-toxic yet eliminate bacteria and viruses where you touch, breath, work and live.

Producing Excelyte™ involves using a simple solution of salt and water to create an environmentally responsible solution with powerful disinfecting characteristics.

Excelyte™ is a powerful antimicrobial solution that is both biodegradable and non-accumulative. The key active ingredient, 0.46% hypochlorous acid, is derived from naturally occurring salt minerals and water.

Excelyte,™ produced by our EcaFlo™ electrolytic cell, is capable of meeting industrial performance standards in quality, reliability, and production capabilities.

NO HARMFUL IMPACT

When exposed to environmental conditions, Excelyte™ quickly degrades into salt and water leaving no ecological footprint.

Much like the human body immune system, Excelyte™ is an antimicrobial solution formed from naturally occurring elements. Excelyte™ attacks an array of microbial organisms including bacteria and viruses.

-

Excelyte™ is non-flammable and contains no alcohol.

-

It can be transported as a non-chemical with no strict HAZMAT requirements

-

Excelyte™ is made up of 99.5% water.

-

Excelyte™ kills viruses and bacteria offering a better alternative to the harmful chemicals in use today for disinfecting and sanitizing.

Sources: The Company, OxBridge Research, OTCKING, DailyStockDeals, OTCstockIQ

Don't miss the NEXT premium Alert! Sign-up, Get Alerts,MakeMoney!®

Disclaimer/Disclosure: we received or expecting compensation from the featured company. Our firm, principals and staff may own/buy/sell/trade stock/securities of this company. Always Read the full Disclosure/Disclaimer. Thanks.

Want to get your company featured? or have questions/comments, please don't hesitate to contact the Editor. editor [@] OxBridgeResearch.com

KiOR, KIOR, Profile, Summary

KiOR | KIOR | Profile | Summary

KiOR is a next-generation renewable fuels company that has developed a proprietary technology platform to convert biomass into renewable crude oil that is processed into gasoline, diesel and fuel oil blendstocks. The company built the first commercial scale cellulosic fuel facility in Columbus, MS, which started production in 2012. KiOR strives to help ease dependence on foreign oil, reduce lifecycle greenhouse gas emissions and create high-quality jobs and economic benefit across rural communities.

Key differentiating factors about KiOR include:

-

Breakthrough technology that leverages proven process

-

Ability to use of abundant non-food feedstocks

-

Access to a vast global market and large base of customers

-

Experienced management team that can deliver accelerated growth.

Technology

KiOR has developed a proprietary technology platform to convert sustainable, low-cost, non-food biomass into a hydrocarbon-based renewable crude oil. Using standard refining equipment, the company processes its renewable crude into gasoline and diesel blendstocks that can utilize the existing transportation fuel infrastructure for use in vehicles on the road today.

In essence, KiOR’s technology simply reduces the time it takes to produce oil from millions of years to a matter of seconds. The company’s technology platform combines its proprietary catalyst systems with a process based on existing Fluid Catalytic Cracking (FCC) technology, a standard process used for over 60 years in oil refining. The efficiency of KiOR’s process, called Biomass Fluid Catalytic Cracking (BFCC), and the proven nature of catalytic cracking technologies allow for significant cost advantages, including lower capital and operating costs, versus traditional biofuels producers.

KiOR processes its renewable crude oil in a conventional hydrotreater, which is a standard process unit used in oil refineries, into gasoline and diesel blendstocks that can be combined with existing fossil-based fuels and used in vehicles on the road today.

Products

KiOR produces renewable gasoline and diesel blendstocks that are comparable to their fossil-fuel based counterparts and can easily be dropped-in to the existing fuel supply, offering a more environmentally friendly fuel option to consumers at the pump. According to a full lifecycle emissions analysis of KiOR data, based on the Argonne National Laboratory's Greenhouse Gases, Regulated Emissions and Energy Use in Transportation, or GREET model, using KiOR'sdata, KiOR’s gasoline and diesel blendstocks are projected to reduce direct lifecycle greenhouse gas emissions by more than 80% compared to fossil-based gasoline and diesel.

Given the infrastructure compatibility of its renewable fuels, KiOR expects to access the $2 trillion global transportation fuels market while also benefiting from government programs, such as the US Renewable Fuel Standard.

KiOR’s renewable blendstocks can be combined with conventional gasoline and diesel fuels by refiners and oil companies and sold to distributors of finished products, or end users of fuel products. To date, KiOR has signed fuel offtake agreements with Hunt Refining, Catchlight Energy, and FedEx Corporate Services, thus demonstrating its ability to fulfill the needs of a variety of customers.

Greenhouse Gas Reductions

While KiOR’s blendstocks are comparable to their fossil fuel-based counterparts, because they are made from renewable biomass, they can contribute to significant reductions in carbon emissions. In fact, on a full lifecycle basis, KiOR’s gasoline and diesel blendstocks are projected to reduce greenhouse gas emissions by over 80% compared to the fossil-based fuels they displace, according to an analysis of KiOR data by TIAX LLC.

Sources: The Company, OxBridge Research, OTCKING, DailyStockDeals, OTCstockIQ

Don't miss the NEXT premium Alert! Sign-up, Get Alerts,MakeMoney!®

Disclaimer/Disclosure: we received or expecting compensation from the featured company. Our firm, principals and staff may own/buy/sell/trade stock/securities of this company. Always Read the full Disclosure/Disclaimer. Thanks.

If you want to get your company profiled or have questions/comments, please don't hesitate to contact the Editor [@] OxBridgeResearch.com

ZaZa Energy , ZAZA, Profile, Summary

ZaZa Energy , ZAZA, Profile, Summary

ZaZa Energy Overview

CONSOLIDATING A DOMINANT POSITION IN THE EAGLEBINE

> High concentration of liquid?rich assets in the Eaglebine and Eagle Ford trends

> ~110,000 acre presence within the Eaglebine and Lower Cretaceous window

> 7,600 acres surrounded by Devon’s recently acquired $6 billion GeoSouthern Eagle Ford assets

> Completed amendment to Eaglebine/Eagle Ford East joint venture agreement with large independent operator

> Accelerated timing

> Contiguous JV acreage footprint

> Immediate liquidity (~$17.8MM net cash) and production (~$17MM in PDP value)

> 6 well carry program

> Proven management team

> Significant experience with majors and large independents

> Collectively participated in the drilling and completion of over 5,500 wells

UNCONVENTIONAL ASSETS – POST CONVENTIONAL THINKING

> Technical evaluation of the juncture between the organic and carbonaterich Eagle Ford group and the silica rich Woodbine plays provided an operational thesis to make the Eaglebine an area of primary focus

> Analogous to mature Eagle Ford area

> Large potential resource play with stacked pay

> Oil/liquids rich in multiple zones

> Multiple zones act as an acreage multiplier

> Significant successful offset activity

MILESTONES - POSITIONED FOR RAPID VALUE CREATION-

> Secured a first mover advantage in the Eaglebine/Eagle Ford East play

> Consummated joint venture agreement with a large independent operator to develop Eaglebine/Eagle Ford East acreage

> Accelerated original joint venture agreement through an amendment to acquire additional production and further develop our acreage block

> Entered joint venture agreement with Sabine Oil & Gas LLC, a First Reserve portfolio company, to develop Sweet Home Eagle Ford acreage

> Strategically completed sale of non core Moulton Eagle Ford assets for approximately $38 million

> Reduced senior secured notes to $26.8 million from $100 million

> Drilled and completed 4 proof?of?concept wells during 2013

EAGLE FORD SHALE PROPERTIES

JOIN VENTURE

Sabine Oil & Gas LLC (“Sabine”) and ZaZa entered into a 75/25 joint venture for the development of ZaZa’s Sweet Home prospect in the Eagle Ford trend located in the liquids window of De Witt and Lavaca Counties, Texas

> Sabine carries ZaZa for two commitment wells and up to $750,000 of construction costs related to gathering and infrastructure in exchange for a 75% interest in 7,600 net acres and the Boening well. Sabine also carries up to

$300,000 of ZaZa’s expenses related to the extension and renewal of certain leases

>> If Sabine completes the first commitment well by February 15, 2014, ZaZa will transfer to Sabine a 75% interest in approximately 3,200 net acres and the Boening well

>> If Sabine completes the second commitment well by April 15, 2014, ZaZa will transfer to Sabine a 75% interest in the remaining net acres (4,400)

• Assuming the initial two commitment wells are successful in achieving production, participating interests in any additional wells drilled or lease

acreage acquired in the Sweet Home prospect will be shared 75% by Sabine and 25% by ZaZa under an Area of Mutual Interest (“AMI”) that will expire on September 15, 2015

SWEET HOMEPROSPECT

> +200’ thick Eagle Ford pay section with >8% porosity in

thickest portion of organic shale

> Adjacent to and surrounded by Devon’s recently acquired $6 billion GeoSouthern Eagle Ford assets

>> Visible oil growth in low?risk, repeatable play

> ZaZa’s Boening well began with an initial production rate of 669 Boe/d

PROVEN BUSINESS MODEL

Initial Appraisal

• Regional geologic evaluation

• Depositional model, subsurface analysis, 3D seismic

• Hydrocarbon system, maturity, geochemistry

• Begin building subsurface model

• In?depth data analysis

• Analyze all area logs and rasters

• Analyze all nearby core data if available

• Maturity/TOC/XRD, mineral composition, fracability

• Detailed log correlations and custom petrophysics

Proof of Concept

• Drill pilot well, take full suite of logs and core

• Mud logging, ISO analysis, insitu fluid composition

• Open?hole logging (rock properties, matrix mineralogy, clay

type, hydrocarbon saturation, stress analysis, rock mechanics)

• Core analysis

• Maturity/TOC/XRD, mineral composition, fracability

• Core calibrated to petrophysics

• Integration

• Detailed pilot to lateral rock properties calibration

• Custom frac design and execution

• Microseismic monitoring and tracer analysis

Capital Markets Access

• Strengthening balance sheet

• Optimizing capital structure for growth

• Transact to accelerate cash flow

Proven Management Team

Todd Brooks (Founder, Executive Director, President &

CEO)

> Founded ZaZa Energy, LLC in 2009. Led company into multiple scaled drilling and development JVs in the Eagle Ford and Eaglebine. Took ZaZa public via reverse merger in early 2012

> Principal of Neuhaus Brooks Investments of Texas, LLC, a company making strategic energy investments across multiple geographic regions

> Experienced land man, E&P investor and entrepreneur

> B.A. in Economics from Vanderbilt University; J.D. from South Texas College of Law

Ian Fay (CFO)

> Founding Partner at Odin Advisors LLC

> Served as Head of the Energy & Natural Resources Group | Americas at BNP Paribas

> Worked as Managing Director for RBC Capital Markets and Director of M&A for UBS Investment Bank

> B.A. in English from the University of North Carolina at Chapel Hill and Morehead?Cain scholar

Kevin Schepel (EVP Exploration and Production)

> Executive Vice President of Exploration and Production since June 2010

> Served as Vice President of Worldwide Exploitation for Pioneer Natural Resources, Chief Petrophysicist for BHP Petroleum and 15 years as an advanced Geoscientist at Exxon

> B.S. from Michigan State University; Licensed by the Texas Board of Professional Geoscientists

Thomas Bowman (EVP Evaluation, Geology and Geophysics)

> Served in various roles such as Evaluation Manager and Exploration Advisor at Aspect Abundant Shale, Bass Enterprises, Fina Oil and Chemical and Tenneco Oil Co.

> Industry?recognized specialist in identification of resource plays and the utilization of geophysical advancements; involved in the completion of over 1,000 horizontal resource wells across a majority of US shale plays

> B.S. from Montana College of Mineral Science and Technology; Licensed by the Texas Board of Professional Geoscientists

The Advantage

> Light Louisiana Sweet crude pricing offers premium relative to

WTI (~$4.50 per Bbl)

> Gas prices benefit from favorable BTU/GPM content and proximity to Houston area markets

> Quality infrastructure in place with available takeaway capacity

Approach

• Identify trends early / first mover

• Low entry cost

• Large contiguous acreage blocks

• Concentrated area focus

• High?value partnerships

• Oil?weighted properties

• Latest technology

Results

2014 Catalysts

• Viable exploration wells

• Eaglebine development moving forward

• Secure “regularway” financings

Sources: The Company, OxBridge Research, OTCKING, DailyStockDeals, OTCstockIQ

Don't miss the NEXT premium Alert! Sign-up, Get Alerts,MakeMoney!®

Disclaimer/Disclosure: we received or expecting compensation from the featured company. Our firm, principals and staff may own/buy/sell/trade stock/securities of this company. Always Read the full Disclosure/Disclaimer. Thanks.

If you want to get your company profiled or have questions/comments, please don't hesitate to contact the Editor [@] OxBridgeResearch.com

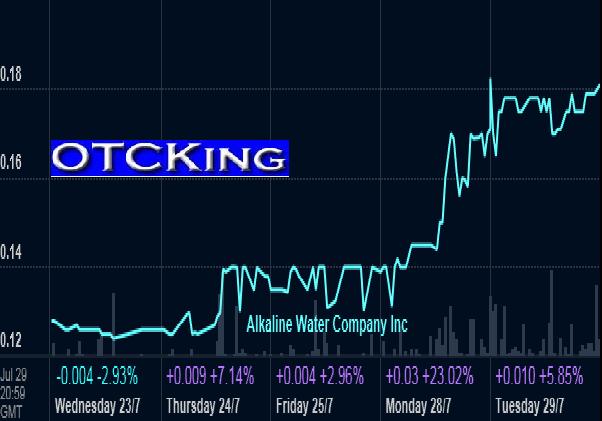

The Alkaline Water Company, WTER, Profile

The Alkaline Water Company | WTER | Profile

![]()

The Alkaline Water Company employs a state-of-the-art Electrochemically Activated Water (ECA) system to create 8.8 pH drinking water without the use of any chemicals. The ECA process uses specialized electronic cells coated with a variety of rare earth minerals to produce scientifically engineered water.The Company further incorporate 84 trace Himalayan minerals considered to be the best in the world.

Waternomics

-

A typical American drinks about 10 cases of bottled water a year.

-

In 2011, total bottled water sales in the U.S. hit 9.1 billion gallons — 29.2 gallons of bottled water per person, according to sales figures from Beverage Marketing Corp.

-

The 2011 numbers are the highest total volume of bottled water ever sold in the U.S., and also the highest per-person volume.

-

Bottled water sales aren’t just growing —they’re booming. Volume increased by 4.1 percent in 2011 —five times as fast as the 0.9 percent growth in the sales of beverages overall, according to Beverage Marketing. Bottled water sales, in fact, are growing twice as fast as the economy itself.

-

The U.S Market is predicted to double in in the next two years.

Water is the new front:

Old Rivals Pepsi & Coke fighting for market share

-

The three global giants in the industry Coca Cola and Pepsi and Nestle

-

Pepsi’s Aquafina, introduced in 1997, is now the number one branded non-carbonated bottled water in the US.

-

Coke’s Dasani, launched a few months later, is second in the category. Both are likely to lead the market in the future.

-

Market analysts look for major consolidation among the plethora of brands in the next few years.

-

It is anticipated that large national marketers will buy local brands around the country and shut them down. Why? To reduce competition and, in some cases, to acquire other supply sources for spring water.

-

The battle between Coke and Pepsi and the larger European brands is the “high profile war that will be waged,” predicts at least one industry insider, who adds that branding will remain a deciding factor for discerning consumers. “Quality and trust are going to be critical, so brands will be important.”

The Opportunity

Virtually no competitive products sized larger than 1.5 L in the market.

-

Consumer acceptance for Alkaline water continues to grow significantly due to its many perceived health benefits, making it the water of choice.

-

Bulk Alkaline water can be marketed at a consumer price point significantly less, per ounce, than existing brands.

-

There is a high demand amongst major retailers for bulk alkaline waters.

-

New bulk size option well received by existing consumers of alkaline water.

Sources: The company, OxBridge Research, OTCKING, DailyStockDeals, OTCstockIQ

Don't miss the NEXT premium Alert! Sign-up, Get Alerts,MakeMoney!®

Disclaimer/Disclosure: we received or expecting compensation from the featured company. Our firm, principals and staff may own/buy/sell/trade stock/securities of this company. Always Read the full Disclosure/Disclaimer. Thanks.

If you want to get your company profiled or have questions/comments, please don't hesitate to contact the Editor [@] OxBridgeResearch.com

Penny Stock Monster

Penny Stock Monster Feed Entries

Feed Entries