BioCryst, BCRX, Stock Summary

BioCryst may be a buy, BCRX Bouncing back, still at 50% Discount, Insiders Buying

BioCryst is a commercial-stage biotech company that is committed to delivering extraordinary medicines that help patients live ordinary lives. BioCryst is passionate about advancing novel therapeutics for patients with rare and serious diseases.

BioCryst’s US headquarters is located in Durham, North Carolina, our European headquarters in Dublin, Ireland and our Discovery Center of Excellence in Birmingham, Alabama. With expertise in drug discovery, clinical development, and regulatory affairs, we are advancing clinical programs and generating new compounds from own discovery engine.

BioCryst Pharmaceuticals discovers novel, oral, small-molecule medicines that treat rare diseases in which significant unmet medical needs exist and

an enzyme plays a key role in the biological pathway of the disease. Oral, once-daily ORLADEYO® (berotralstat) is approved in the United States, the

European Union, Japan, the United Kingdom and the United Arab Emirates.

Insiders Buying vs Selling Ratio 2:1

We have noticed a bullish behavior from insiders, a number of insiders bought the stock in the past 12 months, the ratio was about 2 to 1.

European Medicines Agency grants access to PRIME

European Medicines Agency (EMA) has granted access to the Priority Medicines (PRIME) scheme for BCX9250, a novel, oral activin receptor-like kinase-2 (ALK-2) inhibitor discovered and developed by BioCryst for the treatment of fibrodysplasia ossificans progressiva (FOP).

PRIME is a program launched by the EMA to enhance support for the development of medicines that target an unmet medical need. This voluntary program is based on enhanced interaction and early dialogue with developers of promising medicines and is designed to optimize development plans and speed up evaluation so these medicines can potentially reach patients earlier. According to the EMA, developers of medicines that are eligible for PRIME can expect additional opportunities for scientific advice and be eligible for accelerated assessment at the time of application for a marketing authorization.

“Promising results from non-clinical data and the first-in-human Phase 1 safety, tolerability and pharmacokinetics study in healthy subjects formed the basis of the application for PRIME eligibility. We are pleased with the EMA’s decision to grant PRIME eligibility to BCX9250 – the first investigational drug for this indication to receive this designation – based on the early evidence of the potential of BCX9250 to address the unmet need for patients living with FOP. We look forward to applying the benefits available to us through PRIME as we continue to advance our ALK-2 inhibitor program,” said Dr. Helen Thackray, chief research and development officer of BioCryst.

FOP is an ultra-rare, severely disabling genetic disorder characterized by the irregular formation of bone outside the normal skeleton, also known as heterotopic ossification (HO). HO can occur in muscles, tendons, ligaments and other connective tissues. Patients with FOP become bound by this irregular ossification over time, with restricted movement and fused joints, resulting in deformities, restricted mobility and premature mortality.

BCX9250 is designed to inhibit the ALK-2 enzyme, which is a part of the normal signaling pathway for bone formation and responds to binding its specific ligands (bone morphogenic proteins, BMPs) by stimulating normal bone growth and renewal in healthy children and adults. Specific activating mutations of the ALK-2 gene are seen in all cases of FOP. An activating mutation in ALK-2 is necessary for the disease to occur, making the ALK-2 enzyme an ideal drug target for treatment of FOP.

The Company has several ongoing trails at various stages

BioCryst has several ongoing development programs including BCX9930,

an oral Factor D inhibitor for the treatment of complement-mediated diseases, BCX9250, an ALK-2 inhibitor for the treatment of fibrodysplasia

ossificans progressiva, and galidesivir, a potential treatment for Marburg virus disease and Yellow Fever.

RAPIVAB® (peramivir injection) has received regulatory approval in the U.S., Canada, Australia, Japan, Taiwan and Korea.

Editor, Daily Stock Deals

For timely, actionable and potentially profitable news and uncensored views:> sign up for FREE in 15 seconds

Keep an eye on this space for major announcements!

Reminder: Free Membership enables immediate access to @TOP10STOCKS a great way to start your trading day

Source: The Company, OxBridge Research, Daily Stock Deals, PennyStockIQ

OTLC, Oncotelic, AI Powered Immunology

Oncotelic Therapeutics, OTLC, is a unique Immuno-Oncology company at the cutting edge of medical research and discovery of precision medicine – Oncotelic is creating new pathways by combining AI tools to accelerate discovery by a magnitude, the AI (in the cloud) helps their team of scientists select the best and most effective molecules, eliminate subpar molecules from the earliest stage of discovery, thereby, saving precious time and increasing the chances of breakthrough discoveries, eliminating the probability of errors and omission by a significant margin, and by merging the AI tools with proven expertise in medicine, the Oncotelic team has cut the time and reduced R&D budget leakage and waste by a huge margin, at Oncotelic every R&D dollar is optimized to deliver better ROI and highly effective drugs/therapies in the most efficient manner than ever before.

Oncotelic is led by one of the most renowned scientists in America, a pioneer in immuno-oncology, a man with 39 Patents to his name and over 100 Patent Applications Pending – Dr. Vuong Trieu.

Dr. Vuong was a joint patent holder who helped develop the block-buster billion dollar drug Abraxane™ - now owned by Bristol-Myers Squibb, NYSE: BMY, a $144 billion dollar company.

Dr. Vuong has put together a team of highly distinguished scientists and researchers, and a superb management team with years of proven marketing, brand building and scaling experience – a team that has turned startups into multi-billion dollar enterprises.

Oncotelic Developing Distinct Drugs Targeting Several Extremely Brutal Diseases (Each of them has the potential to be a block buster) let’s focus on one for now.

Primary Focus:

The one we are most excited about for the time being (without diminishing the importance of the other drugs that are in various stages of development) is a potential therapy that could increase the efficacy of an existing FDA approved drug (by as much as 100%) a drug that has generated over $17 billion in revenue last year alone and expected to hit $20 billion in 2025. The name of the drug is Keytruda owned by Merck.

Keytruda meet > OT-101

What Dr. Vuong and his excellent team did here is absolutely breathtaking! Dr. Vuong likes Keytruda, it’s great and it’s helping a lot of folks but it could do more, a whole lot more! When you combine the existing drug (Keytruda) with Dr. Vuong's breakthrough discovery (after the FDA approval) the initial indications are that the rate of efficacy of Keytruda can increase by up to 100%!

Dr. Vuong’s newly discovered - inhibitor blocker eliminator – when given to patients along with Keytruda, the patients who are currently not benefiting can benefit! Imagine the relief combo-therapy can bring to the patients and their families around the world, right now, a lot of patients who can not benefit from Keytruda alone – can soon benefit from the combination therapy which Dr. Vuong has discovered!

Dr. Voung's discovery is one of the most brilliant things I’ve ever seen – let me recap – A highly successful FDA approved Block Buster Drug that’s on the market today, whose efficacy can jump as much as 100% from where it is now – That’s what motivates me and the team at Oncotelic, a lot of patients and their families are needlessly suffering now!

As an investor you obviously look at the size of addressable market and that’s what motivates investors, right? As I’ve mentioned Keytruda has made $17 billion for Merck last year – if Dr. Vuong’s invention/discovery helps increase the efficacy rate of Keytruda even by only 50%, you do the math! We are talking about an opportunity worth billions! Think about it.

OT-101 Pipeline

Oncotelic is an artificial intelligence driven immuno-oncology company with a robust pipeline of first in class TGF-β immunotherapies for late stage cancers such as gliomas, pancreatic cancer and melanoma. OT-101, the lead immuno-oncology drug candidate of Oncotelic, is a first-in-class anti-TGF-β RNA therapeutic that exhibited single agent activity in relapsed/refractory cancer patients.

Rare Pediatric Cancer Designation

Oncotelic is seeking to leverage its deep expertise in oncology drug development to improve treatment outcomes and survival of cancer patients with a special emphasis on rare pediatric cancers. Oncotelic also has rare pediatric designation for DIPG (OT-101), melanoma (CA4P), and AML (OXi 4503). The Company also acquired ("PointR") Data in November 2019.

Management Team

Dr. Voung Trieu, PHD, CEO, Chairman

Dr. Trieu, an expert in pharmaceutical development, currently serves as CEO/Chairman of Oncotelic Inc. Previously he was President and CEO of Igdrasol- developer of 2nd generation Abraxane- where he pioneer the regulatory pathway for approval of paclitaxel nanomedicine through a single bioequivalence trial against Abraxane. When Igdrasol merged with Sorrento Therapeutics, he became CSO and Board Director. He was Board Director of Cenomed- a company focusing on CNS drug development. Before that he was Director of Pharmacology, Pharmacokinetics, and Biology at Abraxis where he lead the development of albumin encapsulated therapeutics along building high throughput platform for small molecules, mirRNA, kinases. Prior to that he was Group Leader at Applied Molecular Evoluton where he was developing biobetter for Humira and Enbrel. Before that he was Director of Cardiovascular Biology at Parker Hughes Institute. Dr. Trieu holds a PhD in Microbiology, BS in Microbiology and Botany. He is member of ENDO, ASCO, AACR, and many other professional organization. Dr. Trieu published widely in oncology, cardiovascular, and drug development. Dr. Trieu has over 100 patent applications and 39 issued US patents.

Seymour Fein, MD, CMO

Dr. Fein’s professional activities have been focused on drug development research for over 35 years. He has been extensively involved in the successful evelopment of numerous drugs, biologics and medical devices over this time leading to FDA approvals for over 20 drugs (NDAs, sNDAs, BLAs) and devices (PMAs). Dr. Fein began his career at Hoffmann-La Roche Ltd. as a senior research physician and was responsible for a clinical development program that led to U.S. Food and Drug Administration (FDA) approval of recombinant interferon-alpha for cancer treatment. Dr. Fein was also the medical director of Bayer Healthcare Pharmaceuticals (U.S.) where he was responsible for therapeutic areas including gastroenterology, oncology, and cardiology. He later served as medical director for Rorer Group (now part of Sanofi) and Ohmeda (now part of Baxter). Dr. Fein founded and has been managing partner of a clinical and regulatory consulting organization and has worked closely with the Division of Gastroenterology and Inborn Errors Products at the FDA. He has participated in the development of and FDA approval of numerous drug products in many therapeutic areas. Dr. Fein has successfully overseen entrepreneurial drug development leading to the FDA approval of two orphan drug products in the field of gastroenterology.

Dr. Fein received his B.A. degree from the University of Pennsylvania and his M.D. degree with honors from New York Medical College. He completed a three-year residency in internal medicine at Dartmouth and a three-year fellowship in medical oncology and hematology at Harvard Medical School, where he served as an instructor of medicine during his final fellowship year. Dr. Fein is board-certified in both oncology and internal medicine.

Amit Shah, CFO

Amit Shah, age 53, has served as a senior financial officer for a number of life science companies, including Chief Financial Officer at Marina Biotech, Inc., a publicly traded biotechnology company (2017 to 2018); Vice President of Finance & Accounting and Acting Chief Financial Officer at Insightra Medical Inc. (2014 to 2015); VP Finance and Acting Chief Financial Officer at IgDraSol Inc. (2013); Corporate Controller & Director of Finance at ISTA Pharmaceuticals (2010 to 2012); Corporate Controller at Spectrum Pharmaceuticals (2007 to 2010): and as Controller / Senior Manager Internal Audits at Caraco Pharmaceuticals Laboratories (2000 to 2007). In addition to his work with life sciences companies, Mr. Shah served as the Chief Financial Officer at Eagle Business Performance Services, a management consulting and business advisory firm (2018 through March 2019) and as a consultant and ultimately Senior Director of Finance – ERP, at Young’s Market Company (2015 to 2017). Mr. Shah received a Bachelor’s of Commerce degree from the University of Mumbai, and is an Associate Chartered Accountant from The Institute of Chartered Accountants of India. Mr. Shah is also an inactive CPA from Colorado, USA

Saran Saund, CBO/GM of AI Division

Silicon Valley entrepreneur, Saran has been founder, CEO and GM at startups and public companies. Passionate about applying technology innovations to real world markets, he successfully founded an AI consortium to accelerate enterprise adoption of AI which engaged leading universities and technology vendors. A startup veteran, his track record includes senior leadership roles at companies that were acquired by leaders such as Marvell (MRVL) and Qualcomm (QCOM). His startup Cybercash (CYCH) had a successful IPO on NASDAQ. Saran started his career at Xerox PARC pushing 1’s and 0’s as a software engineer

Anthony E. Maida III, PhD, Chief Clinical Officer-Translational Medicine

Dr. Maida, an expert in immuno-oncology, currently serves as Senior Vice President – Clinical Research at Northwest Biotherapeutics, Inc. Prior to joining Northwest Dr. Maida served as Vice President, Clinical Research and General Manager, Oncology, World-wide at PharmaNet, Inc. Prior to joining PharmaNet Dr. Maida served as Chairman, Founder and Director of BioConsul Drug Development Corporation and Principal of Anthony Maida Consulting International, servicing pharmaceutical firms, venture capital, hedge funds and Wall Street. Dr. Maida’s skill set includes the leading execution and oversight of finance, operations, research, clinical and scientific development, regulatory and manufacturing for the development of various oncology immunotherapies. Over the past 25 years Dr. Maida has served in a number of executive roles, including, Chairman, CEO, COO, CSO, CFO and business development. Over recent years Dr. Maida has raised, or assisted in financings, nearly $200 million for emerging biotechnology companies. Dr. Maida serves as an advisor, consultant and technical analyst for CMX Capital, LLC, Sagamore Bioventures, Roaring Fork Capital, Toucan Capital, North Sound Capital, The Bonnie J. Addario Lung Cancer Foundation and vFinance; the later three companies are located on the East Coast. Additionally, Dr. Maida has been retained by Abraxis BioScience, Inc., Northwest BioTherapeutics, Inc. and Takeda Chemical Industries, Ltd. (Osaka, Japan). Dr. Maida holds a Ph.D. in Immunology, a B.A. degree in Biology, a B.A. Degree in History, a MBA and a MA in toxicology. He is a member of the American Society of Clinical Oncology (ASCO), the American Association for Cancer Research

About Daily Stock Deals / Today's Top 10 Picks

Daily Stock Deals helps emerging growth companies reach individual and institutional investors. Daily Stock Deals and its affiliates publish research reports, market analysis and daily stock picks to help investors make informed decisions and achieve their individual investment goals. Our Platform is supported by companies we profile on our network, therefore, our views are neither free of conflict, nor intended as advise to buy/sell any securities and we strongly urge you to read our TOS, Disclaimer/Disclosure and consult with qualified experts. If you would like to get your company featured on Daily Stock Deals network or have any questions, please feel free to contact the editor. This e-mail address is being protected from spambots. You need JavaScript enabled to view it thanks!

Daily Stock Deals is an affiliated/partner property, please read TOS/Disclaimer/Disclosure, thanks!

IQST, Company Profile, Summary

iQSTEL, IQST, is based in Florida and serves mainly countries in the Caribbean and Latin America, the region of Latin America and the Caribbean is one of the fastest growing consumer markets in the world.

The company’s top executives have a great insight and deep knowledge of the region, its people and know how the governments in these countries operate. The unique insight has helped the company establish successful telecom, transport and financial services in each country then they manage to interconnect consumers from their neighboring countries, opening up more opportunities for people to communicate and trade and loop back to the USA, making the network as a whole more valuable and scalable. iQSTEL has created a vibrant ecosystem that has been growing each year, contributing double digit revenue gains and helping company introduce new services and gain more customers.

Telecom

Services: SMS, VoIP, PBX, Omnichanel services, International Fiber-Optic connectivity for 5G.

Electric Vehicle (EV)

Services: Electric Motorcycles for Latin America, One - Stop - Shop solutions for Electric Vehicles (EV) industry: EV Batteries, EV Chargers, EV Battery Management System, IoT Connectivity, Mobile App for EV connectivity, EV Dashboard Display, etc.

Fintech

Services: Visa/Mastercard Money One (Visa/Mastercard debit card), Remittances, Mobile Top Up, Cryptocurrencies Exchange Services.

Technology (IoT)

Services: Internet of Things (IoT) Devices and Platforms IoTSmartGas, IoTSmartTank.

Blockchain

Services: Blockchain Platforms Solutions: Mobile Number Portability Application (MNPA), Settlement and Payment Marketplace (SPM).

About Daily Stock Deals / Penny Stock IQ

Daily Stock Deals helps emerging growth companies reach individual and institutional investors. Daily Stock Deals and its affiliates publish research reports, market analysis and daily stock picks to help investors make informed decisions and achieve their individual investment goals. Our Platform is supported by companies we profile on our network, therefore, our views are neither free of conflict, nor intended as advise to buy/sell any securities and we strongly urge you to read our TOS, Disclaimer/Disclosure and consult with qualified experts. If you would like to get your company featured on Daily Stock Deals network or have any questions, please feel free to contact the editor. This e-mail address is being protected from spambots. You need JavaScript enabled to view it thanks!

Daily Stock Deals is an affiliated/partner property, please read TOS/Disclaimer/Disclosure, thanks!

Orchid Ventures Inc., ORCD, ORVRF, Company Profile

Orchid Ventures Inc., (CSE:ORCD) , (OTC:ORVRF), is an innovative and vertically integrated company offering high-quality handcrafted cannabis products to consumers. After extensive research and development, the flagship Orchid Ventures, Inc. brand, Orchid Essentials, launched in 2017. Orchid partnered with the leading manufacturer in vape hardware to create sleek and discrete delivery systems. These unique cartridges are powered by a long-lasting, heavy-duty battery with variable power settings. Additionally, Orchid partners with a team of scientists to create extracts made with strain-specific profiles utilizing cutting-edge terpene reintroduction technology to ensure each batch produces uniform flavor and effect. Combined, the cartridges and battery provide what many say to be the best experience for vaporizing cannabis and CBD.

The company is poised to meet the increasing demand from the fast-growing recreational market and the rapidly expanding CBD health-enhancing products market. According to Arcview Market Research and BDS Analytics, the global cannabis market is poised to reach $57 billion in size by 2027. The U.S. cannabis market is in line to reach $23 billion by 2025, based on New Frontier Data’s research.

The Products

The company’s flagship brand, Orchid Essentials, features proprietary, custom-designed vape devices. Vape devices are highly popular and quickly gaining a considerable market share in the cannabis space. These elegantly designed devices are powered by a highly energy-efficient, quick charging, long-lasting battery that can keep you puffing for up to two full 1-gram cartridges on a single charge, in comparison to many other batteries that would struggle to get through one on a single charge.The battery comes fully charged, ready to amaze and delight consumers as soon as they get it home and pair it with their favorite Orchid Essentials cartridge.

Orchid’s research partner has developed a wide variety of flavors that capture subtle notes and full-bodied taste and deliver a unique experience with every puff you take. One can easily experience the joy any time of the day or night. Among the most popular Orchid Essentials cartridges are Tropical Trainwreck, a strain that produces an uplifting, giggly effect and tastes of delicious citrus, and Jack Herer, one of the most popular Sativa strains available today, is loved for the boost of energy it imparts.

The utmost attention to detail and formulation ensures a consistent, smooth experience that both new users and vaping aficionados appreciate. All Orchid Essentials batteries also come with a full 365-day warranty.

Leadership

Corey Mangold, Founder / CEO and Director

Corey Mangold is the Principal and Co-Founder of Gigasavvy, a leading southern California creative marketing agency. He's established a thriving agency that has launched and managed campaigns for Toshiba, Knott's Berry Farm, Johnny Rockets, Hi-Chew Candy, Tenet Healthcare and Northgate Markets to name a few. Corey has also worked tirelessly to create a thriving culture at Gigasavvy that has been recognized, 3 years running, as a "Top 10 Places" to work in Orange County.

As the CEO of Orchid Essentials, Corey brings 20 years of start-up experience and a knack for developing successful companies. Corey's vision and extensive experience in marketing/advertising, branding, design, sales and product development has already established Orchid as the brand to beat in the market.

"We intend to scale business by establishing ourselves as the dominant vape product in each market that we enter. We will then follow up in each market and provide additional product options as we expand. We are very excited for the upcoming Orchid Ventures listing on the Canadian Securities Exchange, and furthering our plans for global expansion."

Rick Brown, President

Rick's career in general management and marketing has spanned multiple countries and across a diverse set of industries such as CPG, Retail, Healthcare, and Financial Services. During his career, he has specialized in both scaling up companies with high growth potential and transforming businesses to energize revenue growth. He is a creative and influential leader with a history of crafting and implementing breakthrough strategy and innovation by leveraging his marketing expertise with deep operational experience and a strong financial acumen. Rick has considerable experience as a senior executive working with Boards on designing and developing strategy then aligning the company, including the Board Of Directors, on key growth priorities.

Most recently Brown spent 5 years with H&R Block as President of their Canadian operations, where he had full P&L responsibility and led the growth of tax and financial services for this $300 million company, plus built a proprietary digital tax software platform and e-commerce business.

Prior to this Rick was Chief Marketing Officer and SVP, Sales and Business Development for a healthcare service company in the US called Smile Brands, a market leader in the dental care sector with $500 million in revenue, serving 2+ million patients annually. He played a major role in navigating the company through an IPO process which ended in the private sale of the company in 2011.

Tom Soto, Board Chairman

Tom Soto is a long-time investor in the impact sector. Having sold Craton Equity Partners to Trust Company of the West (TCW) in 2013, he became Managing Director of Alternatives at the $198 billion fund. He also served as an Investment Committee Member of TCW and Craton Alternatives.

His leadership, voice and investments have stood at the dovetail of energy, Tech, cloud based and IoT efficiency programs in renewables, and to over many Fourth Industrial Revolution driven platforms where technology contributes to improving the human condition. This ranges from Fintech, to electric vehicle technology and policy, to political process and regulatory frameworks needed to promote the new economics driving the planet into a future of prosperity and abundance. Tom has a full understanding and history of sourcing opportunities, performing full due diligence, modeling, building organizational performance and measurement capacity along with building boards of directors and leading portfolio companies toward successful exits.

Tom is currently Chair of the Advisory Board for Aura, which is the nation’s leading online microfinance institution based in Silicon Valley.

Robert MacDonald, Board Member

Robert MacDonald is an influential, trusted advisor with deep board and corporate governance expertise in energy, clean technology, banking and manufacturing industries. He has had success in raising billions of dollars in capital to catapult startups and growth companies into thriving, profitable entities. He has positioned businesses for successful IPO or sale; restructure underperforming operations while gaining investor confidence and capturing up to four times the capital investment. He achieved measurable results by controlling hold periods and formulating exit strategies. He has served on 23 board of directors for 16 private and seven public companies, raising over $8 billion in funds over his extensive career.

In 1981, MacDonald, together with two other former Salomon Brothers principals, founded Catalyst Energy Corporation. Catalyst grew to become one of the largest IPPs in the country and was worth over $1 billion with nearly 800 employees and revenues of $414 million. In 1988, Catalyst was sold to the Bronfman family for $1 billion. From this point, MacDonald continued to finance the development of more innovative environmental technologies and power production. From 1988 to 1992, he was a co-founder and co-chairman of Eastrock Partners in New York where he provided private investment and financial consulting services to a variety of clients. In 1993, he joined William E. Simon & Sons L.L.C. He then became President of Simon Private Equity and served on its investment committee where he was responsible for all aspects of the management of Simon Private Equity. In 2006 Mr. MacDonald co-founded Craton Equity Partners I & II with Tom Soto. After the sale of Craton II, Bob served as a Senior Advisor to a number of private equity funds.

Product Availability and Expansion Strategy

Orchid Essentials products are currently available to consumers in California andOregon through a wide network of more than 345 stores, and the company is planning to expand to an additional five more territories in the near future and expects retail availability to exceed to 600 stores or more. In addition, the company is in on-going discussions with a number of strategic acquisition targets, some of which are expected to close in the near future.

About Daily Stock Deals

Daily Stock Deals helps emerging growth companies reach individual and institutional investors. Daily Stock Deals and its affiliates publish research reports, market analysis and daily stock picks to help investors make informed decisions and achieve their individual investment goals. Our Platform is supported by companies we profile on our network, therefore, our views are neither free of conflict, nor intended as advise to buy/sell any securities and we strongly urge you to read our TOS, Disclaimer/Disclosure and consult with qualified experts. If you would like to get your company featured on Daily Stock Deals network or have any questions, please feel free to contact the editor. This e-mail address is being protected from spambots. You need JavaScript enabled to view it thanks!

Daily Stock Deals is an affiliated/partner property TOS Disclosure/Disclaimer

What's Next for Anthera Pharama? ANTH to focus on Kidney Failure and Renal Disease

Anthera Pharma, ANTH, Profile, Summary

Anthera Pharmaceuticals (ANTH) is a clinical-stage biopharmaceutical company focused on developing products to treat serious and life-threatening diseases, including exocrine pancreatic insufficiency and B-cell associated renal diseases.

The company was developing a Cystic Fibrosis drug called ‘Sollpura’ ,the drug was being developed in partnership with Eli Lilly, Sollpura was targeted for people who were suffering from Cystic Fibrosis which also affects pancreas and makes it much harder to digest food, the slow progression of indigestion could lead to adverse outcome including death.

Sollpurawas a ‘pure’ PIG FREE drug, unlike other drugs on the market which are derived from Pig Enzymes, Sollpurawas Kosher-Halal drug so people who prefer to avoid the consumption of drugs derived from Pigs were naturally very excited about this brand new drug.

The drug was in ‘third stage’ of clinical trials, unfortunately, the drug didn’t meet the expectation and wasn’t as effective in the late stage trials, so the company, after years of research and 100s of millions of expense, had no choice but to suspended all clinical trials of Sollpura.

The CEO released the following statement:

“We are greatly disappointed by the findings of the RESULT study,” shared

“We would like to extend our deepest gratitude to the patients and their families, study investigators, and the cystic fibrosis community for the support they have provided in the clinical development of Sollpura.”

As a result Anthera Pharmaceuticals was delisted from NASDAQ and currently trading on OTC Markets. The company has also been working on Kidney disease for a long time.

Blisibimod

Blisibimod was licensed from Amgen in December 2007 with exclusive worldwide rights. Blisibimod targets B-cell activating factor, or BAFF, which has been shown to be elevated in a variety of B-cell mediated autoimmune diseases, including Immunoglobulin A nephropathy, or IgA nephropathy, systemic lupus erythematosus, or lupus, and others.

Blisibimod is currently in development for the treatment of IgA nephropathy (IgAN). IgAN (also known as Berger’s disease) is the most common cause of primary glomerulonephritis worldwide, occurring more frequently in Asia than in Europe or North America. IgAN is characterized by deposition of IgA-anti IgA immune complexes in the kidney, resulting in inflammation, the leakage of blood and protein into the urine, and loss of kidney function. The disease typically progresses slowly but as many as 40-50% of patients will eventually develop end-stage-renal disease and require dialysis or kidney transplant. There are currently no approved therapies for IgA nephropathy

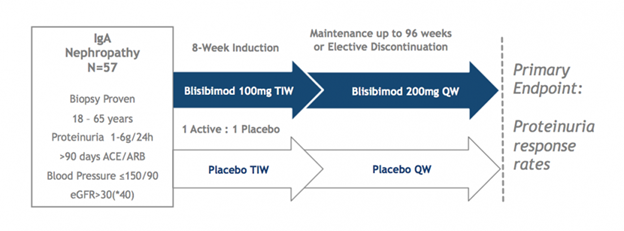

Bright • SC

The Phase 2 BRIGHT-SC study enrolled 57 patients with biopsy-proven IgAN, 42 of whom completed at least 60 weeks of evaluation and 21 of whom completed at least 104 weeks. Two interim analyses showed favorable trends as compared to placebo on the progression of proteinuria and expected pharmacological effects (reductions in circulating B cells and serum immunoglobulins). Dosing is now completed and study results are expected in Q3 2017. Patients with persistent proteinuria (1-6 g/24hrs), despite stable background optimized therapy with angiotensin converting enzyme inhibitors (ACEi) or angiotensin receptor blockers (ARB) for at least 90 days and estimated glomerular filtration rate >30mL/min/1.73m2, were randomized to receive either blisibimod (300mg/week for 8 weeks and 200mg/week thereafter) or matching placebo for up to 104 weeks and had the option of being followed thereafter in the absence of study drug to assess longer term outcome. ACEi or ARB was continued throughout the trial as background medication. Patients were not allowed to receive corticosteroids for the treatment of IgA nephropathy within 3 months of screening.

In the most recent interim analysis, the effects of blisibimod versus placebo were assessed through at least the 48 week time point in all patients. Patients had biopsy-proven IgA nephropathy with a mean proteinuria level of 2.4 grams and an estimated glomerular filtration rate of less than 70 mL/min/1.73m2 – indicative of stage 2 chronic kidney disease per the National Kidney Foundation. A positive trend on proteinuria by blisibimod was observed. Consistent with the previously announced Week 24 analysis, blisibimod treated-patients over time demonstrated stable to slightly decreased levels of proteinuria, as assessed by urinary protein to creatinine ratio (PCR), as compared to slowly increasing levels of proteinuria in the placebo group. 44 of the original 57 patients had a Week 48 observation and 22 patients had a Week 96 observation at the time of this analysis.

Source: The Company, OxBridge Research, Daily Stock Deals, OTC Stock Wire

Don't miss the NEXT premium Alert! Sign-up, Get Alerts, MakeMoney!® Disclaimer/Disclosure: we received or expecting compensation from the featured company. Our firm, principals and staff may own/buy/sell/trade stock/securities of this company. Always Read the full Disclosure/Disclaimer. Thanks.

If you want to get your company featured on Daily Stock Deal or want to learn more, please contact the Editor. Thanks you!

Penny Stock Monster

Penny Stock Monster Feed Entries

Feed Entries